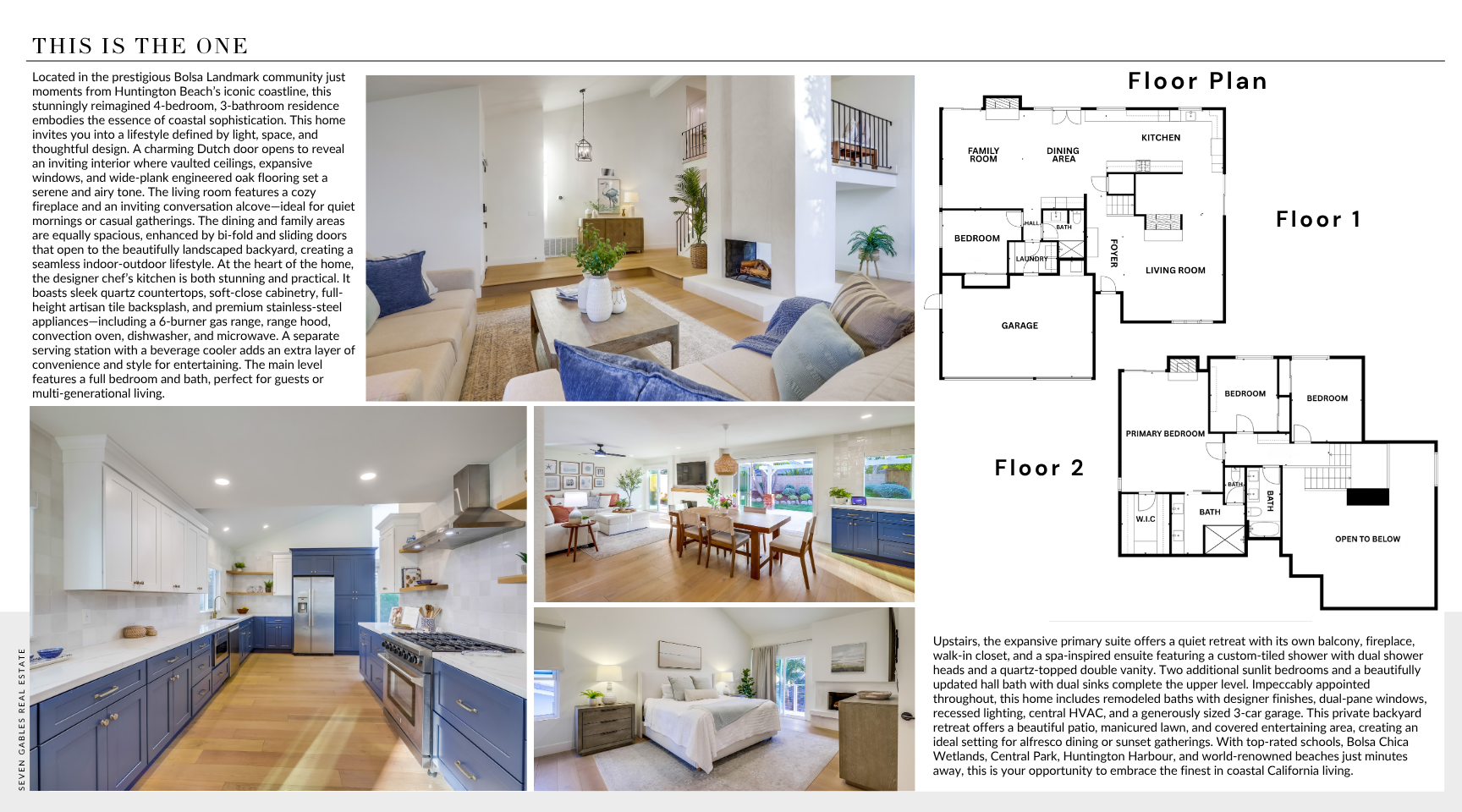

Located in the prestigious Bolsa Landmark community just moments from Huntington Beach’s iconic coastline, this stunningly reimagined 4-bedroom, 3-bathroom residence embodies the essence of coastal sophistication. This home invites you into a lifestyle defined by light, space, and thoughtful design. A charming Dutch door opens to reveal an inviting interior where vaulted ceilings, expansive windows, and wide-plank engineered oak flooring set a serene and airy tone. The living room features a cozy fireplace and an inviting conversation alcove—ideal for quiet mornings or casual gatherings. The dining and family areas are equally spacious, enhanced by bi-fold and sliding doors that open to the beautifully landscaped backyard, creating a seamless indoor-outdoor lifestyle. At the heart of the home, the designer chef’s kitchen is both stunning and practical. It boasts sleek quartz countertops, soft-close cabinetry, full-height artisan tile backsplash, and premium stainless-steel appliances—including a 6-burner gas range, range hood, convection oven, dishwasher, and microwave. A separate serving station with a beverage cooler adds an extra layer of convenience and style for entertaining. The main level features a full bedroom and bath, perfect for guests or multi-generational living. Upstairs, the expansive primary suite offers a quiet retreat with its own balcony, fireplace, walk-in closet, and a spa-inspired ensuite featuring a custom-tiled shower with dual shower heads and a quartz-topped double vanity. Two additional sunlit bedrooms and a beautifully updated hall bath with dual sinks complete the upper level. Impeccably appointed throughout, this home includes remodeled baths with designer finishes, dual-pane windows, recessed lighting, central HVAC, and a generously sized 3-car garage. This private backyard retreat offers a beautiful patio, manicured lawn, and covered entertaining area, creating an ideal setting for alfresco dining or sunset gatherings. With top-rated schools, Bolsa Chica Wetlands, Central Park, Huntington Harbour, and world-renowned beaches just minutes away, this is your opportunity to embrace the finest in coastal California living.

Click Here To Check It Out On YouTube: https://youtu.be/yFWEEhUlHPU

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)