🔔One of the more important real estate changes coming in 2026 has nothing to do with rates or pricing.

There’s an important change coming that anyone involved in real estate, especially buyers using LLCs or trusts, should be aware of.

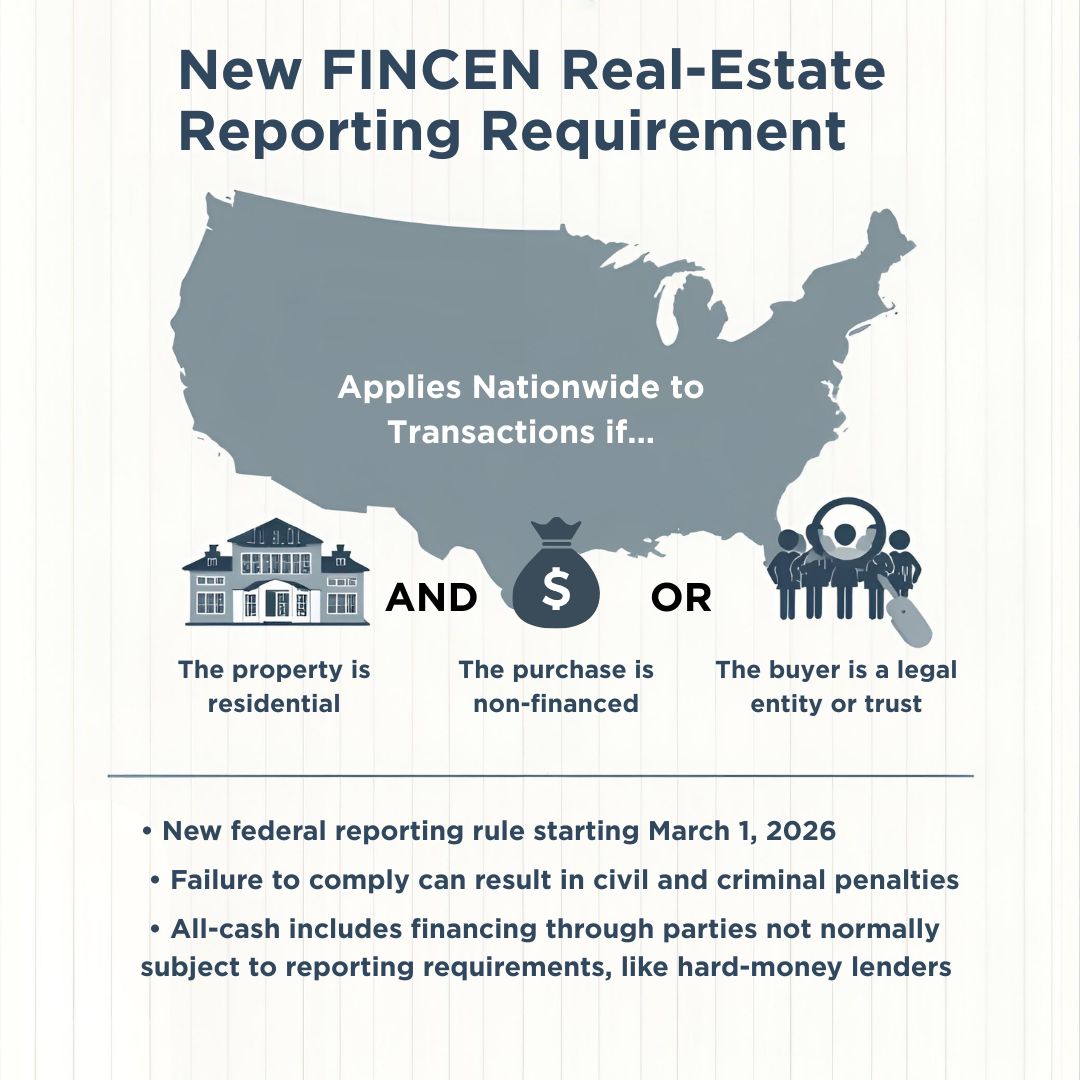

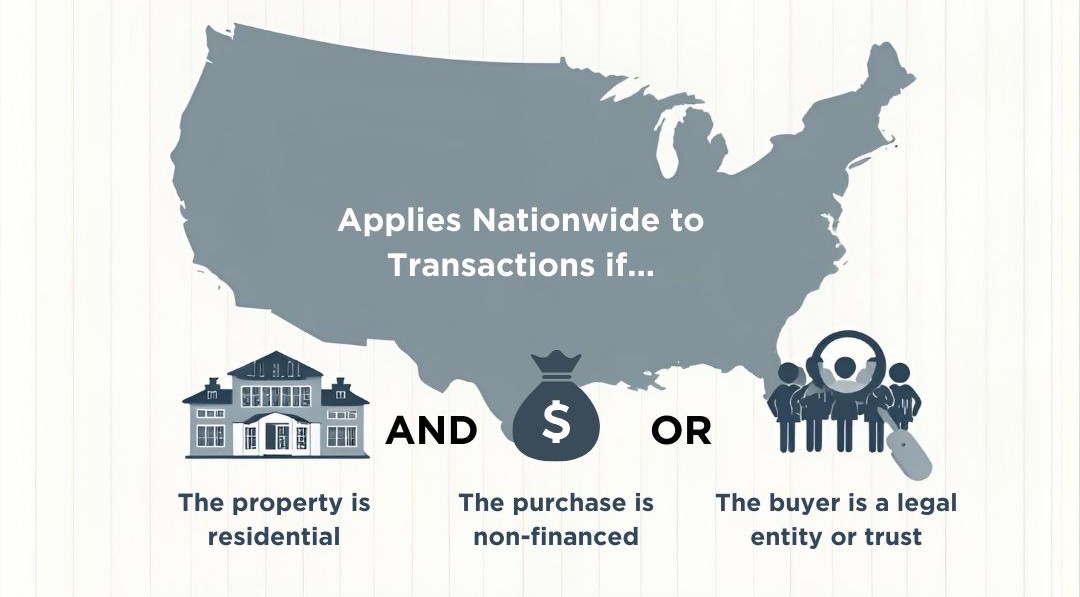

Beginning March 1, 2026, a new federal reporting requirement from the Financial Crimes Enforcement Network (FinCEN) will apply to certain residential real estate transactions.

In simple terms, when residential property is purchased without traditional financing and the buyer is a legal entity or trust, additional ownership and transaction details will now be reported at closing.

This rule is not about restricting purchases or changing how people buy real estate. It is about transparency and making sure the right information is documented upfront so transactions move smoothly.

What I am already seeing is that the best outcomes happen when these conversations start early, not at the closing table. Understanding structure, ownership, and reporting expectations ahead of time helps avoid surprises and delays.

As always, clarity before pressure is key. Thoughtful planning today makes tomorrow’s decisions easier.

.png)

Cutting back on extras

Cutting back on extras Swapping to cheaper brands

Swapping to cheaper brands Ignoring the noise and thinking long-term

Ignoring the noise and thinking long-term Going back to basics with cash and gold

Going back to basics with cash and gold Strengthening family ties

Strengthening family ties